Business interruption claims a year on: what have we learnt so far?

25th January 2022

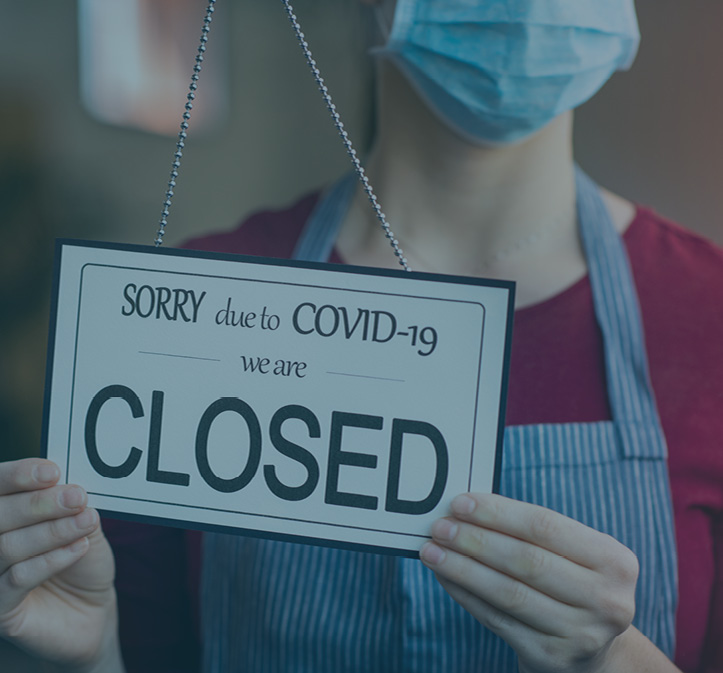

One of the most discussed court cases across the UK insurance market – if not the most spoken of in 2021 was the Supreme Court ruling on business interruption (BI) cover for businesses forced to shut down their operations during Government imposed lockdown restrictions. The ruling provided clarity on the contractual interpretation of a number of BI policies commonly used in the market, but also brought the tough challenge of handling a backlash of BI claims held up in anticipation of the Supreme Court decision.

A year on, numerous settled claims later, what have we learnt? Our Head of Major Complex Loss Operations, Graeme Bell reflects on how the industry has combatted the challenge and whether it has delivered the claims experience policyholders deserve.

Our approach to tackling the peak in claims and where we are today

There were initial concerns last year, that the market would be overwhelmed by a sudden rise in claims volumes. Business interruption is quite a complex field that often requires the support of experts to reach settlement. At Davies, we streamlined our approach to handling BI claims, and it has worked well, with excellent feedback from both our clients and their policyholders.

Rather than request reams of information which would invariably arrive in different formats, we created a standardised form with customised questions for the customer to answer. This captured key financial data and was complemented by the customers’ profit and loss statements, enabling us to use standardised formulas to calculate the loss more efficiently. The calculation was then sent to the policyholder or their representative by way of settlement offer which meant the calculation was transparent and followed the settlement steps as per the policy.

Resource has been vital. To support the influx of claims and meet our client’s requirements, we recruited a team of highly experienced BI loss adjusters, including those unable to undertake worldwide catastrophe work due to Covid and a number of semi-retired or retired happy to return to work to keep active during the Government restrictions. We have settled over 90% of our BI claims volumes to date, and the remainder are generally awaiting information from the policyholders or their professional advisers.

Protecting insurers and indemnity spend

To protect our clients, we initially completed some general housekeeping; checking the policy cover and following the insurer’s technical guidelines. In some cases this was more complex than you’d expect, for example, we often had to check whether there was a case of covid within a 25-mile radius of the risk address (there usually was given how widespread covid was and is). After validating policy cover, we confirmed if the claim met the criteria in accordance with the policy.

Standard quantum steps of a business interruption claim also helped to calculate the loss. By following the calculation under each policy, adjusters protected indemnity spend. We looked at the loss of turnover, the trend of the business and calculated the rate of gross profit and applied this to the loss of turnover. Savings including furlough payments were taken into account to accurately establish the customer’s true financial loss.

The covid pandemic is a niche and unique situation that has impacted our daily lives, our communities, our industry, and the world.

Throughout this difficult and changing time, communication has been essential. Communication between insurers, brokers and third-party suppliers has been key to understand each other’s challenges and priorities, and to be able to support each other to deliver the service policyholders deserve.

We’ve seen real positive impact from internal communications too, bringing teams together on a weekly basis to discuss ideas and approaches has been helpful to tackle the complex nature of BI claims.

For more information and to continue the conversation, please contact Graeme Bell, Head of Major Complex Loss Operations via Graeme.Bell@davies-group.com

Related Articles

-

- Article

- Claims Solutions

Building material shortages pile on the pressure

This article was first published in Insurance Post With building material…

-

- Article

- Claims Solutions

Stephen Kavanagh, Managing Director of Casualty Claims reveals the past, present and future of COVID-related claims

This article was first published in Insurance Business UK As a…

-

- Article

- Claims Solutions

Getting to know our adjusters: Interview with Michaela Robertson, Senior Associate

Tell us about your role, career background and what you find…

-

- Article

- Claims Solutions

- Legal Solutions

How to reduce the claims backlog

This article was first published in Insurance Business UK Mia Wallace…